Loan repayment: a burden on the Yemeni economy [Archives:2002/09/Business & Economy]

February 25 2002

Yemen could regain its debt schedule in accordance with Paris Club meetings, which has been decreased from US $10 billion to US $4 billion. Yemen has plans to loan YR 15.772 billion to finance crippled investment projects.

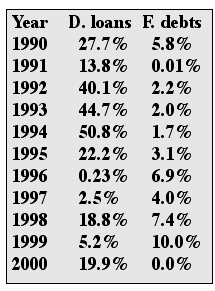

The treasury bills have become a source for domestic loans to finance pivotal projects. The table shown illustrates that the government has depended on domestic loans rather than foreign debts. As a result of this, foreign debt policies will greatly affect some of the developmental projects. Among these is bearing additional amounts of money as that of loan interest. If loans have been utilized for the benefit of the purchasing unprofitable materials such as, weapons, this will lead to unproductive economic burdens. Similarly, lenders will demand of paying back their loans with hard currencies at the expanse of national income, while our national wealth has been deteriorating considerably.

According to economic statistics, the existing balance of the foreign debts have reached USD 4943.5 at the rate of 66% out of the overall domestic production for the year 2000. Accordingly, the government has restored loans by way of weekly treasury bills. This has created inflationary spirals and incapacitates in economic relations and helped a lot in deteriorating the national currency. It is noteworthy that the government has adopted loan policies as the first step to support the budget deficit. Statistics have shown that the overall public debts, both domestic and foreign, in 1999 has reached YR 987.03 billion, at the rate of 78.4 % of the overall domestic production. A part of this sum, YR 153.69 billion, refers to domestic public debts and YR 833.07 to foreign debts.

To sum up, foreign and domestic loan policies have hurt economic growth. Our country has been left to pay back debts at the expense of other important commitments and future projects.

——

[archive-e:09-v:2002-y:2002-d:2002-02-25-p:./2002/iss09/b&e.htm]