Yemens Manufacturing Sector [Archives:2002/05/Business & Economy]

January 28 2002

1. Manufacturing Activities in Pre-Unification Period

Manufacturing activities in Yemen expanded in the early 1970s as a result of the momentum demand for consumer goods (fueled mainly by workers remittances from the Gulf and foreign aid) and the government policies for granting economic incentives for local manufacturers using import substitution policies including protective measure such as tariffs, quantitative restrictions, price controls, and later by encouraging manufacturers for export production. Despite differences in the political and economic systems in the former republics, the public sector took the lead in manufacturing activities in both countries. In the North (PDRY), the government pursued the creation of a strong public sector to carry out all economic activities and nationalized most of private sector manufacturing establishments. In the Yemen Arab Republic, although the private sector (local and foreign) was allowed to invest in manufacturing and played an important role in its development, manufacturing investments were driven mainly by the public sector.

Import substitution policies, pursued in the 1970s and the 1980s provided the necessary impetus for producing manufactured goods such as food products, footwear, clothing, leather products, drugs, and construction materials. Public sector manufacturing activities focused on large-scale projects such as cement, cotton, tobacco, drugs, petroleum, textiles, printing and, to some extent, food processing. The private sector concentrated its activities on food and beverage processing, building materials, woodwork, leather, soap production and light engineering.

2. Current Characteristics of Manufacturing Activities in Yemen

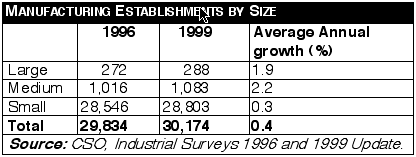

In the 1990s, manufacturing output expanded markedly particularly during 1990-1993. However, it was still concentrated in oil refining and production of consumer goods. Total number of industrial establishments, which was 33,284 in 1996, increased to 33,699 in 1999, and is estimated at 33,972 by 2000. According to the 1999 industrial survey, the number of manufacturing establishments was 30,174. Of these, 1% were large establishments (more than 10 workers), 4% were medium-scale (4-9 workers) while the bulk (95%) of the manufacturing establishments were small-scale. In the late 1990s, large and medium-scale establishments expanded more quickly than small-scale firms.

Manufacturing activities in Yemen are characterized by: (i) high degree of industrial and geographical concentration; (ii) family and private ownership; (iii) a very low ratio of value-added to inputs (40%); and, (iv) self-financing of investment and activities. In 1999, more than half of all manufacturing establishments were in food processing. This followed by textiles, clothing and leather (13%) and woodwork and furniture (12%), non-metallic construction manufacturing (10%) and other metal products. Similarly, manufacturing activities are concentrated in a few governorates. About a quarter of all manufacturing establishments are located in Sanaa, followed by Ibb (13%), Taiz (9%), Dhamar and Lahj (8% each) and Hodeidah (7%). These six governorates and the Capital secretariat host more than 71% of total manufacturing establishments in Yemen.

With regard to ownership of establishments, 99% of all manufacturing (and 67% of large) establishments are owned by private Yemeni citizens, 0.4% by the public sector (19% of large establishments), 0.3% by cooperatives, 0.4% are joint ventures and only 0.1% is owned by foreigners. Furthermore, the manufacturing sector employed 95,413 workers in 1999 (2.5% of the 4.2 million total labor force), mainly in food processing (40% of total manufacturing work force), followed by textiles, clothing and leather (14%), construction materials (13%), wood furniture and metal products (with 11% each). About 36% of employments in the sector takes place at large establishments, 7% at medium-scale establishments and 57% at small enterprises.

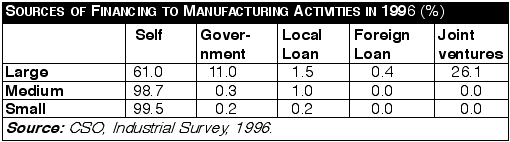

Financial institutions contribute only marginally to the financing of manufacturing activities in Yemen. According to the 1996 survey, 99% of small and medium establishments were self-financed. For large firms, owners financed 61% of activities from own resources, followed by joint ventures financing (26%) and the government with 11%.

The total value added of manufacturing sector was YR 103 billion in 2000 (34% of which is oil refining), and mainly contributed by large establishments (67% of total manufacturing value-added), followed by small (29%) and medium (4%) establishments. The ratio of value-added to input is low and estimated at 40% in 1999 (with marked differences between large, medium and small establishments). At sectoral level, among the non-oil refining manufacturing, food products and beverages value-added was the highest (23% of total manufacturing value-added), followed by structural non-metallic products (13%), tobacco (12%), wood products (3%), paper, printing and publishing (4%), wood work and furniture (3%), metal products (3%) while the share of textiles declined to less than 1% of total manufacturing output.

3. Manufacturing Output, Contribution to Growth and Exports in the 1990s

Manufacturing contributed one-third of industrial valuedadded (9% of GDP) in the 1990s. Activity was strong during 1990-1993 and declined by more than 5% in 1994. For the whole period of 1990-1994, growth of manufacturing value added averaged only 2.1% (3.0% excluding oil refining). The good performance during 1990-1993 was due to the fact that the sector continued to work under the umbrella of the protection system and government subsidies. The decline in output in 1994 was attributed mainly to the civil war that year which caused enormous damage to life and property. After the civil war, activity picked up and certain activities managed to grow by more than 20% (e.g., food and tobacco, cement and non-metallic products and furniture). Trade liberalization measures also contributed to the recovery as the cost of imported inputs declined and the devaluation discouraged imported manufactured goods.

Manufacturing activities recovered strongly in 1995 with a growth rate of 24%, and for the period 1995-2000, it recorded an average annual growth of 5.7% (6.8% excluding oil refining) against the First Five Year Plan (FFYP)s planned target of 8.0% per annum. In particular, output grew by an average rate of 0.8% during 1996-1997 (1.3% excluding oil refining). A number of factors contributed to the sluggish growth during the two years. First, the impact of the civil war on Aden oil refinery greatly affected capacity of the refinery and value-added of oil refining declined by 10% in 1994, by 4% in 1996, stagnated in 1997 and declined by 7% in 1998. Second, the cost of production rose as a result of phasing out the governments implicit subsidies to the sector when tariffs for public utilities (water and electricity) were raised.

Manufacturing output (excluding oil refining) started to recover in 1998 with a growth rate of 5.5% particularly in textiles, leather, chemical and plastic products. Output growth slowed in 1999 and recovered strongly in 2000 recording a 7% growth rate. Food and tobacco and cement and other non-metallic product outperformed other sub-sectors during the year. For the period 1998-2000, the sector managed to grow by an average rate of 4.3% (3.8% including oil refining). Despite expansion of the manufacturing sector in the 1990s, it is still oriented mainly to cover the domestic market and its contribution to total exports economy is still small .

In comparison with other countries, manufacturing activity in Yemen is still very weak and its contribution to GDP, economic growth and employment remains tiny. While the total exports of Yemen reached 50% of GDP in 2000, manufactured exports represented less than 1% of merchandise export, 26% of non-oil merchandise exports and less than 0.5% of GDP. The protectionist policies pursued until mid-1990s (subsidies, high tariffs and controlled exchange rate) were unsustainable and have contributed to the fragility and inefficiency of the sector with a great cost to the government budget and social welfare. They reserved the local markets for local production and subsidized imported raw materials and equipment. This indirectly discouraged the manufacturers from improving the quality of their products and management of their establishments. The removal of all bans on imports created a competitive market for local goods in which local manufactures have to compete with imported goods, to improve their mediocre quality and to start reducing the high production costs under which they operate.

After the reforms, and following a couple of years of sluggish growth, manufacturing activities started to recover in the late 1990s.

In addition to its contribution to GDP, the manufacturing sector has important fiscal contributions in the form of direct and indirect taxes (including income, production and consumption taxes as well as taxes on value-added and custom duties on imported raw material). The countrys total indirect tax revenue was YR 55 billion in 1999. According to 1999 survey, the total indirect tax from the manufacturing sector was estimated at YR 10.1 billion representing about 18% of total indirect taxes. With custom duties, the contribution of manufacturing to total indirect taxes reached 21%. The large establishments contributed 98% of total indirect taxes while medium and small establishments contributed only 0.1% and 1.7% respectively.

4. Growth Prospects and Targets of the Second Five-Year Plan (SFYP) for the Manufacturing Sector

Manufacturing has been accorded a high priority by the SFYP as one of the potential engines for rapid economic growth, job creation, attraction of FDI and technical progress, and poverty reduction. The plan aims to: (i) achieve a real rate of growth of 9.2% in manufacturing value-added (7.5% for oil refining), which will raise the share of the sector to 9% of GDP by 2005; (ii) support the orientation towards exports, and; (iii) support and develop small-scale and traditional handicraft industries. The plan hopes that the sector will make use of Yemens comparative advantages in terms of natural resources, human resources, and the strategic location of the country and its accessibility to major international markets. The plan also targets a big increase in exports of manufacturers, with special focus on small and medium scale industries for their ability to create job opportunities and to alleviate poverty. The Plan also accords oil refining a priority and seeks to expand the refining capacities of Aden and Marib refineries and to encourage private sector involvement in the refining activities.

The realization of these targets largely depends on government removal of the constraints in the sector, further trade liberalization, improvements in infrastructure and utilities, improvements in the legal and judicial system. There are good prospects for manufacturing of food and tobacco for exports to the GCC and African countries. There are also good prospects for manufacturing of textiles and garments, construction materials, and furniture and wood work because of the comparative advantages of Yemen in such industries. Finally, the prospects of manufacturing are better with the development of the free zone in Aden

* Source: Final Quarterly Report for 2001 by the World Bank

Economy News

Project to Upgrade Sana’a Airport

The General Authority of Civil Aviation & Metrology signed an agreement with the Engineering Investment House for conducting studies to upgrade Sana’a’ a International Airports phase II at the cost of US$ 2,7000,000.

The first phase aims at modernizing the airport runway and equipping it at the cost of USD 114 billion jointly funded by the Arab Fund for Development and the Yemeni government.

Saudi-US Companies Explore Oil & Gas in Yemen

The Yemeni Ministry of Oil signed two memoranda of understanding with a number of joint Saudi and US companies for exploring oil and gas in blocks # 57 and 58 located in Mareb and Shabwa. The agreement includes carrying out 2000 bi-dimensional km of seismic surveys and 400 km of tri-dimensional seismic wells as well as digging out two exploration wells in block # 574 located in al-Rayan.

Yemen to Construct a New Power Station

Yemen is to build up a new power station of a total output capacity of 120 megawatt at a cost exceeding USD 100 billion to cover the ever-increasing demands for power. Yemen has already posted two international tenders for the construction of the a power station. The first power station will be based in Sana’a and will have an output capacity of 60 megawatt and the other in Aden with the same output capacity. Saudi Arabia will cover the greater part of the cost of the projects.

Cement Sales Soar

The General Authority of Cement Production & Marketing says it expects an increase in cement production by 223,743 tons and a soar in sales totaling 231975 tons. The total production amounted to 493,000 tons. Similarly, the sales of the authority totaled at 1,5200,000 tons.

Investment Projects of 700 Billion

The total number of licensed investment projects in Yemen since the inception of the General Authority of Investments in 1992 till the end of December 2001, totaled 3000,956 projects at the cost of YR 702,280,000. These projects provide 127,625 job opportunities.

——

[archive-e:05-v:2002-y:2002-d:2002-01-28-p:./2002/iss05/b&e.htm]